On June 14th, FTX proposed an order setting up a procedure for customers to register their claims against FTX. The court confirmed the order at a hearing today, June 28th.

The FTX portal will open on July 3rd at the URL address http://claims.ftx.com. Customers of FTX must access the portal and register their claim by Sept. 29th, 2023, 4pm Eastern Time (New York time zone). Customers who fail to register their claims by the deadline will not be able to assert their claim in bankruptcy court, will not be able to vote on the Plan of Reorganization, and will not receive a distribution under the plan.

All customers of FTX should go through the claim registration process.

Claim registration procedure

Login to FTX portal

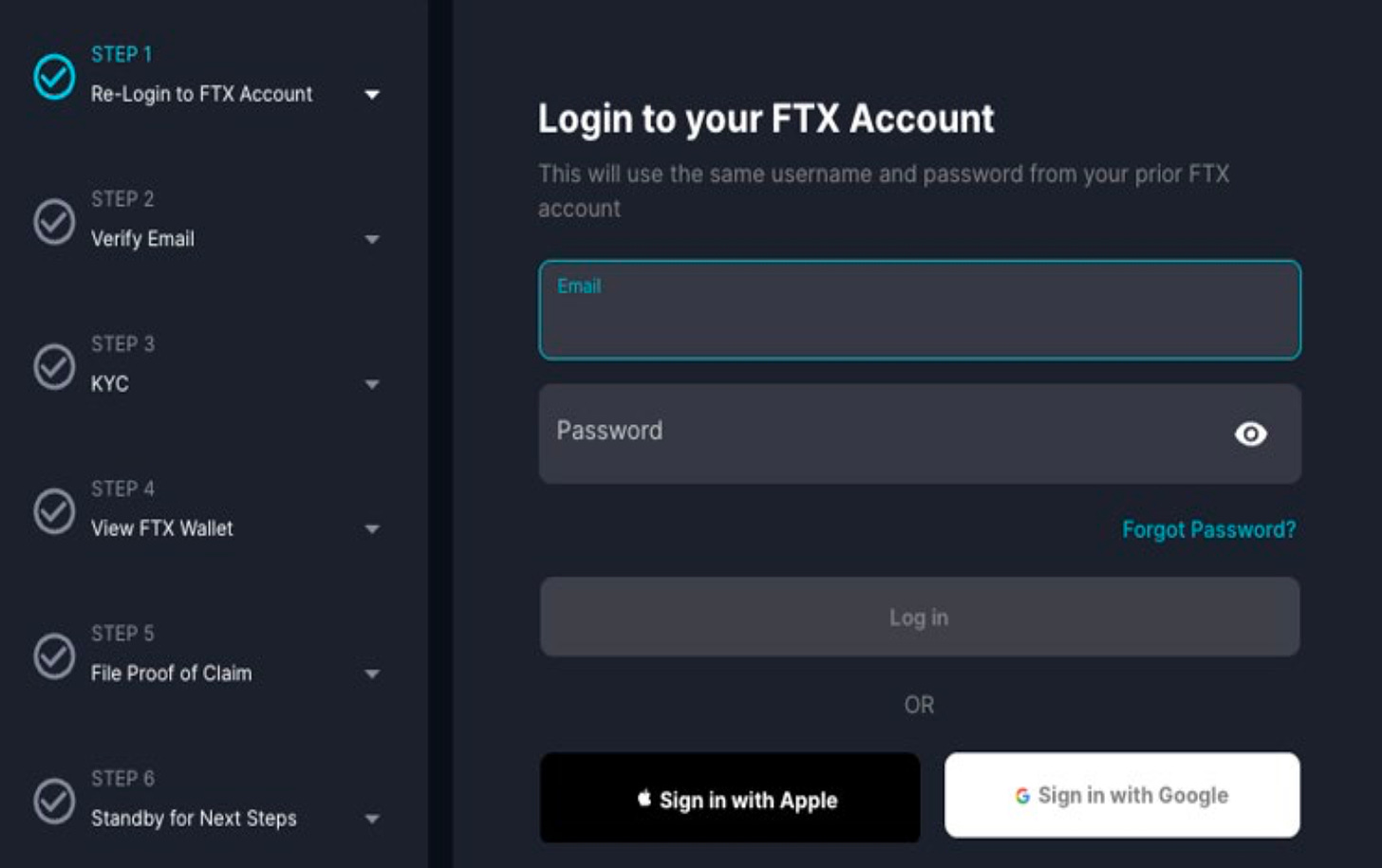

On or after July 3rd, login to the FTX portal. You should be greeted by the following login screen:

Your old username and password should work (there’s also a standard password recovery option). You will be asked to verify your email before proceeding.

Submit KYC information

The new management of FTX has no plans to play fast and loose with regulatory risk. Given the lax KYC (Know Your Customer) policies of the previous team, there’s danger that some accounts at FTX are linked to money laundering, terrorism, sanctions violations, and other prohibited activities. FTX will redo KYC for all accounts as part of the claims registration process. As a side benefit, fresh KYC will make claims trading easier because buyers of claims can rely on FTX KYC procedures instead of doing their own for each trading counterparty.

The KYC party has to be the original customer. If a claim had been transferred or sold, the buyer will have to find the seller and make them complete KYC.

If a customer already filed a claim with the bankruptcy court, they still have to go through KYC. There’s really no way to avoid it.

Individual customers

Individual customers will be asked to provide some or all of the following information:

Full name

Date of birth

Address and proof of address

ID documents (passports, drivers license, ID card, or similar)

Phone number

Email address

Occupation

Bank account information or crypto wallet address

Social security number or taxpayer ID number

Facial liveness (real time scan of face with a smartphone or webcam)

Institutional customers

The KYC procedures for institutional customers will be more onerous, asking for some or all of the following information:

Company name

Company registration information

Tax identification information

Principal business address and phone number

Business email address

Nature of business and principal activity

Entity size

Source of funds

Annual revenue and profit

Bank account information and/or crypto wallet address

Identity of directors, management members, authorized signers, and ultimate beneficial owners (UBOs). Each person listed will have to provide the same personal information as individual customers.

Failure to complete the KYC process does not disallow the claim. The claim is, however, classified as “unverified”. FTX has not decided how to handle unverified claims. It may allow them or it may not. It will consult with the Unsecured Creditors’ Committee before it makes a decision, which will then have to be confirmed by the court. If the court disallows unverified claims, creditors will get another chance to submit KYC even after the customer claim deadline on Sept. 29th.

Review account balances and historical transactions

After completing KYC, customers will be redirected to a different website that will be run by the claims agent, Kroll Associates. The claims platform will show account information which includes balances and historical transactions. Customers should review them and check against their own records. If their records agree with the claims platform, no further action is required. The claims registration process is complete.

If, however, there are discrepancies, customers can go ahead and file an amended proof of claim.

File an amended proof of claim

The easiest way to file an amended proof of claim is to use a form on the claims platform. There will be links to upload supporting documentation as well.

It is also possible to submit amended proof of claim via mail or courier, even though few customers will bother. The written proof of claim has to be in English and the claims agent must receive it by the claims deadline. Emailed proofs of claim will not be accepted and will be ignored.

Exceptions

Customers of FTX Japan, Liquid, and FTX EU do not have to register their claims using the above procedure. These three platforms restarted withdrawals for their customers and have their own process to access customer balances.

Impact on claims trading

The secondary market in FTX bankruptcy claims has been slow to develop. Claims buyers had to contend with the difficulty of confirming that the claims were valid and had to worry about the risk of clawbacks of pre-bankruptcy withdrawals. Lots of legal expense had to go to drafting case-by-case customized documents containing representations and warranties for each trade. The claim registration process should ease the legal burden on claims trading and make smaller size claims tradable.

Kroll Associates, the claims agent, will publish the following information:

whether the claim has been acquired from someone else

whether the claim amends a previously filed claim

whether another party has filed a proof of claim for this claim

whether the claimant participated in FTX Earn, Lend, or Stake programs

asserted quantity of crypto and fiat currency

asserted NFTs

any asserted Other Activity Claim

Claim buyers will be able to easily confirm their counterparty representations. Furthermore, the availability of historical transactions data will make clawback risk transparent and quantifiable.

We think that this will jumpstart the secondary market in FTX claims.

Final notes

Court filings related to the claims process revealed two points of interest.

FTX will treat FTX customers as creditors to all the companies in bankruptcy. There is no separation of claims against FTX International from FTX.us, Alameda Research, or FTX Ventures. Their combined assets will be used to fund claim recoveries.

FTX has not committed to converting account balances to US dollars. Claims will be registered in kind, reflecting cryptocurrency balances as of petition date. The court may, in the future, direct FTX to dollarize the claims but the possibility of recovery in kind remains open.

The claims registration process was long in coming. It is a crucial step in sorting the FTX mess out. Hopefully we’ll see a lot more progress in the coming months.