Two weeks ago, the US Internal Revenue Service (IRS) filed claims for unpaid taxes against Alameda Research and related companies that, on their face, add up to $44 bn in value. This news is causing consternation among FTX creditors because IRS claims have super priority status in bankruptcy: the sovereign gets paid first. I’d like to calm everyone down. The news is not as bad as the headlines suggest.

The IRS does not have final say in determining tax liability. A tax court judge will rule on the validity of the claim. The FTX estate has hired plenty of lawyers who can, and will, challenge it.

IRS has a history of filing inflated bankruptcy claims that get settled for pennies on the dollar. As a recent example, PG&E (California’s electric utility) was faced with an IRS claim of $2.5 bn during its bankruptcy process that was reduced to $90m (3.6% of face value). And that was for a legitimate tax delinquency. The numbers in the FTX tax claim are absurd and do not withstand scrutiny.

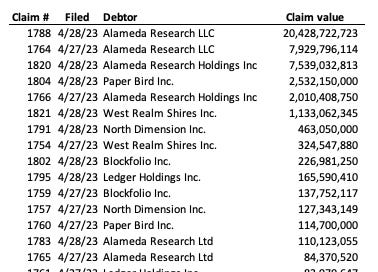

Let’s review the biggest claims (I have included only claims over $50m in the following table):

First thing to note that the $44 bn headline number seems to double count some items. The claims filed on April 27th are labeled “Request for payment” while the claims filed on April 28th are labeled “Proof of claim”. I believe that the claims dated on the 28th contain the amounts in the claims filed on the 27th. The headline number should then be reduced to $33 bn or so.

Second, it’s unclear whether there’s additional double counting from consolidation. Alameda Research Ltd, Alameda Research Holdings, and North Dimension are owned by Alameda Research LLC. Does the Alameda Research LLC claim include claims against its subsidiaries? We don’t know. The clean headline claim number could very well be closer to $25 bn.

Finally, let’s address the absurdity of the IRS claim.

Total US corporate income tax payments run around $440 bn. This single claim would have Alameda Research pay 10% of total US corporate income tax receipts. That just makes no sense. The biggest financial tax payer in the US is JP Morgan Chase Bank which has $3.7 trillion of assets. JPM Chase paid $8.5 bn in corporate income taxes in 2022. If the IRS requests tax payment 5 times bigger than what JP Morgan Chase pays, the proper response is to laugh in their face.

A quick review of the claims brings up multiple problems. I’ll mention two of them:

The $20bn claim against Alameda Research LLC contains $12bn liability for the calendar year 2023. While 2023 is not over yet, I’m pretty sure that Alameda Research is unlikely to generate $57 bn of pre-tax profit (US corporate tax rate is 21%).

The claim against Alameda Research LLC includes an estimated FICA withholding tax of $122m per quarter in 2022, that is $488m per year. The Social Security tax wage limit in 2022 was $147,000, giving maximum Social Security withholding amount of $18,228 (combined employee and employer portion). Medicare tax rate is 2.9% (combined) plus additional 0.9% for wages above $200,000 per year. It’s hard to rack up large FICA withholding without having a lot of employees. FICA liability of $488m per year implies 16,000 employees with an average base salary of $1m each, or 20,000 employees with an average base salary of $250,000 each. And this only includes US-based employees: non-US employees are not subject to FICA withholding.

I suspect that the rest of the IRS claims are similar garbage. It’s shocking how moronic they are. The IRS went full retard.

As Twitter user AFTXCreditor pointed out, FTX’s first day motion of Nov. 19th, 2022 identified $3.7 bn in net operating loss (NOL) carryforwards as of Dec. 31st, 2021, with additional NOL carryforwards generated in calendar year 2022. These carryforwards reflect taxable losses in previous years of operation and can be used to offset future tax liabilities. The FTX estate best estimate is that not only they owe zero taxes, but may be owed refunds.

My best guess is that in the end, FTX will settle the IRS claims for 1% of face value or less, costing creditors about $200m. I will update my estimate as more information comes out. But there’s no need to panic.

I enjoyed this article, specially the title.